The third quarter was interesting to say the least. With the recent market volatility, we’ve received a lot of questions from investors about our own personal feelings towards investing in the stock market. There’s been a lot said about this recent period of unease: from some calling it a market correction, to the often touted adage “It’s only a loss if you sell”. To be fair, it’s advice that’s not too far off the mark.

Historical returns of the S&P 500 since inception has been 7% after adjusting for inflation[1], and some individual stocks have done even better. All this news and data is little comfort for investors counting on regular income from their investments in the short term, or who remain heavily vested in the stock market through their various retirement vehicles. In this post, we want to examine the effect volatility in the market has on individual stocks and indexes, and compare how that fits into our own philosophy.

It’s pretty common that anyone with a retirement account has some level of exposure to the stock market. Whether it be direct through mutual funds or bonds, or indirect exposure as a result of annuity income levels tied to market indices. Some folks even go above that level of exposure and choose to buy shares of companies they believe in or whose products they use. Several members of the Sterling staff hold shares in companies such as GoPro (GPRO), Ford (F), and Disney (DIS). We will examine how these companies performed over the recent months or longer relative to their performance.

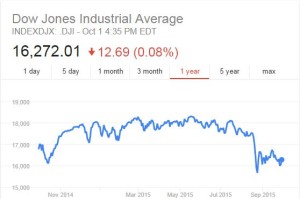

August 24th saw a 1,000 point drop in the DOW, most major indices from around the world closed down this quarter, and each of the three stocks is trading lower than they were July 1st. The past year has seen a nearly 3,000 point gulf between its highest and lowest traded value, a 16% deviation in value that it hasn’t been fully recovered. There’s a variety of things in play here that have pushed markets downward, but the most succinct explanation is uncertainty. Fear in the Chinese stock market is largely a result of the government’s seemingly random reaction, from heavy intervention to hands off, even currency devaluation. The Greek debt crisis was another chapter in the continuing saga of “Will the EU Stay Together”. Our own Federal Reserve Bank seemed all but set to raise rates in September but after a hectic August had decided it was best not to. All of these things have different underlying causes, but all result in uncertainty. And above all, traders hate uncertainty, and as a result, we have market volatility.

As of writing, it’s October 1st, and trading hasn’t been off to a great start for the stocks we mentioned earlier. Each is trending down for the day, Dis down .27%, Ford down 1.16% from its opening, and GoPro down 4.43%. The three-month average shows even bigger drops for each, despite recent successes. Disney released several successful summer movies, including Inside Out and Avengers: Age of Ultron, as well as revenue growth for both its networks as well as theme parks[2]. Ford had a solid third quarter in U.S. sales based on all estimates, which has been the biggest indicator of success lately[3]. GoPro recently released two new cameras to add to their arsenal, a low and high-end version of their already popular Hero4, allowing them to capture even more of the market[4]. All three are trading down, largely due to the external forces outside their control. Even when they’re producing well-known and popular products, companies are as much a subject of the market as investors. This is why much advice steers investors clear of individual stocks. A price goes deeper than just the products being sold by a company; it relies on the fundamentals as well. How the business is run, confidence in its leadership, moves by competitors, impending regulation all affect valuations.

Those of us here at Sterling are not isolated from the stock market. Some of us hold the above stock, and all of us are participants with our retirement savings. For some, retirement is nearer than others and the volatility in the market is highly concerning.

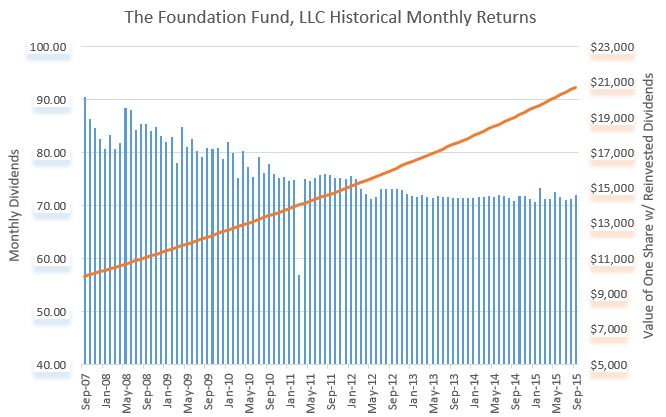

We strive to ensure our trust deed investments always retain solid foundations, with the philosophy that slow and steady wins the race. The Foundation Fund, LLC, our mortgage pool for California residents, has seen a 9.13% return on investment since inception in 2007. The chart above demonstrates a largely consistent monthly return per share over the entire life of the fund. A single $10,000 share would have more than doubled in value with reinvested dividends. By focusing on sound fundamentals, and lending locally, we’ve been able to provide steady returns over the lifetime of our mortgage pools, while minimizing large fluctuations over time. For the investor looking to shield themselves from uncertainty, this can be an excellent alternative to more volatile markets.